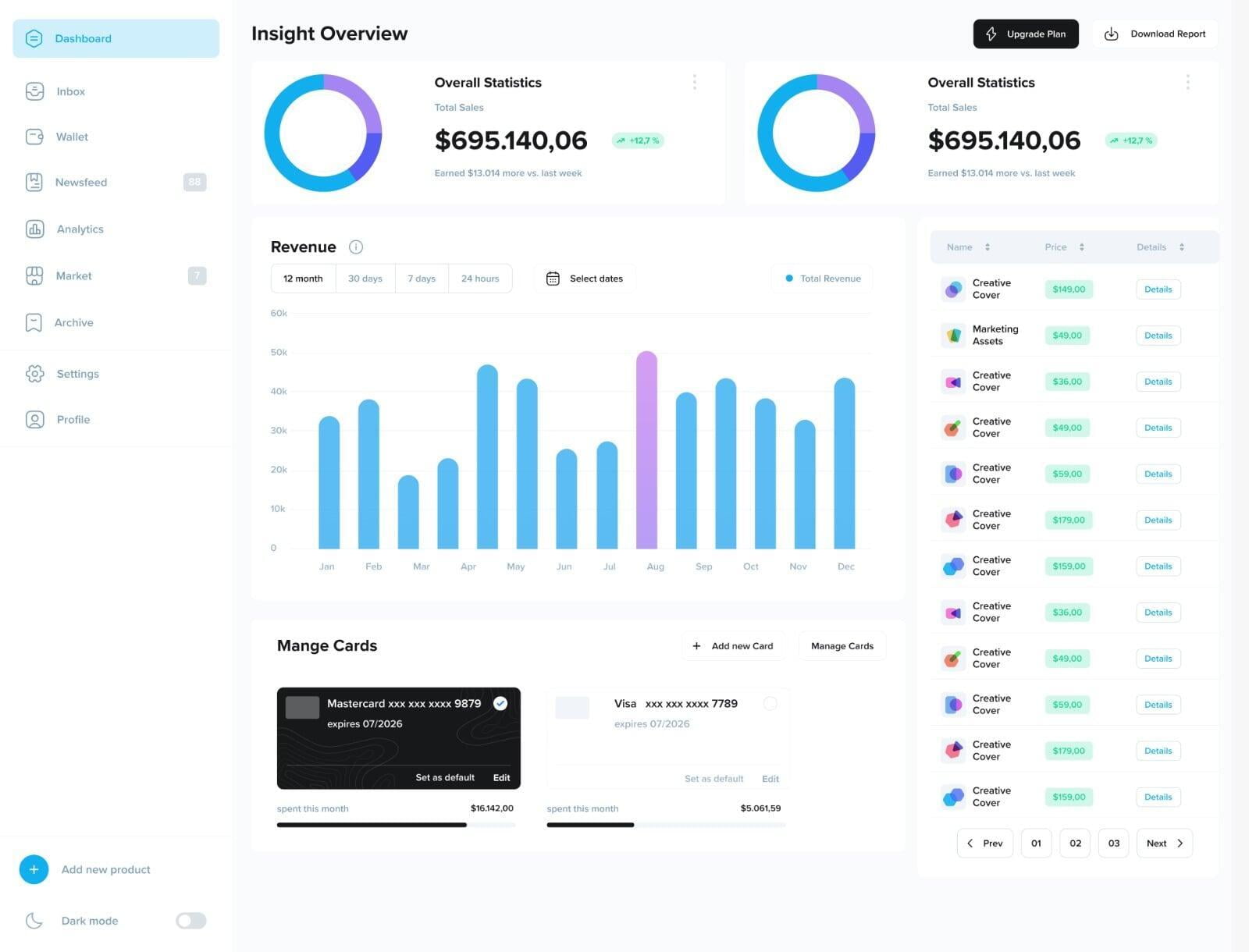

Our online bookkeeping services include:

Precise transaction recording and categorization Precise transaction recording and categorization Credit card and Bank reconciliations Credit card and Bank reconciliations Efficient Sales Tax Filing Efficient Sales Tax Filing  Monthly profit and loss statements, balance sheet and cash flow statements Monthly profit and loss statements, balance sheet and cash flow statements |  Annual or quarterly sales tax filing for GST/HST Annual or quarterly sales tax filing for GST/HST Expert bookkeeping support Expert bookkeeping support Flexible bookkeeping options Flexible bookkeeping options Integration with leading online platforms Integration with leading online platforms |

Ready to let KSBB take care of your bookkeeping needs?

No need to stress about late, missed or duplicate payments again.

Get rid of the stack of invoices on your desk.

No more manual data entry! We are going to introduce a streamlined payment system to submit and approve invoices. All it takes is a quick photo of an invoice and we will take care of the rest. Once invoices are submitted, smart scanning technology will read and extract the data and post it to your books. We’ll take care of the rest and ensure your AP listings are up to date.

Vendor payment management

We tailor our vendor payment management to your preferred methods, ensuring seamless transactions. From electronic transfers to traditional checks, we handle each payment with precision and care, guaranteeing prompt delivery to your vendors.

On time payments

Our commitment to precision and timeliness ensures that your accounts payable listings are always accurate and up to date. Real-time data updates allow you to stay ahead of your financial obligations and maintain a clear overview of your accounts payable.

Vendor Reconciliation Service

Vendor reconciliation is an essential part of our accounts payable services. We meticulously match vendor invoices with corresponding statements to identify and correct any discrepancies. This process ensures that all payments are accurate and helps avoid overpayments, underpayments, and potential fraud. Regular vendor reconciliation not only enhances your financial accuracy but also strengthens relationships with your vendors by ensuring timely and precise payments.

Accounts payable services include:

An experienced team of AP professionals An experienced team of AP professionals Updated AP listings Updated AP listings Paperless invoice management Paperless invoice management Controls for approving invoices Controls for approving invoices |  Process automation for invoice submission & entry Process automation for invoice submission & entry Invoice payments Invoice payments Employee expense reimbursements Employee expense reimbursements Remittance notifications Remittance notifications |

Ready to take paying bills off your plate?

Avoid a late payment becoming a non-payment

Customer reminders reduce receivables

Let us take your account receivables off your plate

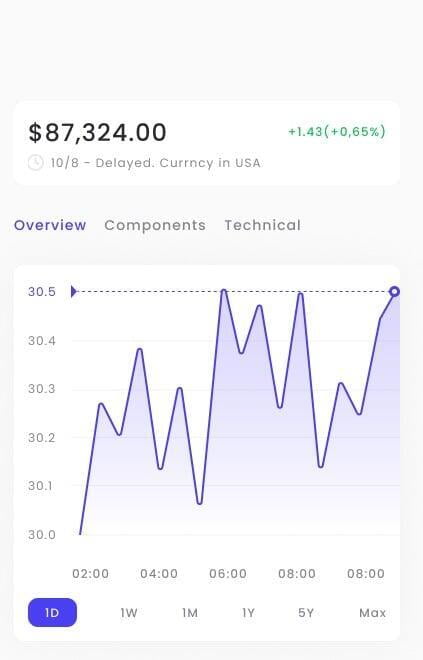

Reduce days sales outstanding (DSO)

With our effective process, we expedite cash collection and reduce the number of overdue accounts. We ensure invoices reach the appropriate person for approval and promptly follow up with the designated contact for payment. Through our established process, we minimize the number of overdue accounts, ensuring a smoother financial operation for your business.

Improve accounts receivable turnover

If you're seeking funding, having a high accounts receivable turnover ratio is essential. Timely collections put you in a stronger position with investors and banks, demonstrating effective financial management and reliability.

Our accounts receivable services include:

An experienced AR team An experienced AR team Proven process for full ownership of receivables Proven process for full ownership of receivables Invoice issuance Invoice issuance |  Updated AR listings Updated AR listings Payment collection and follow-up Payment collection and follow-up Vendor/purchaser reconciliations Vendor/purchaser reconciliations |

Stay on top of your invoicing and collections – we'll take care of it.

Are you months or maybe years behind in your bookkeeping or late in your tax filing?

Sleep easy, we are here to help

Experienced bookkeepers

Up-to-date books are important if you are lookin for new funds.

Tax-ready financials

Tax season concerns are over. Your books will be current and you’ll have everything you need to work with your year-end accountant for your filing.

Back log fees

There won't be any surprises with our fees. We will let you know at the onset the cost to get you caught up with all your backlog. No surprise charges – just accurate, reliable delivery

Our Catch-up Bookkeeping Services include:

Record missing entries and rectify erroneous entries Record missing entries and rectify erroneous entries Bank and credit card reconciliations Bank and credit card reconciliations Up-to-date financial statements Up-to-date financial statements |  Tax-ready financial package Tax-ready financial package Safe online data storage for receipts and documents Safe online data storage for receipts and documents Supporting documents required for COVID-19 government subsidy programs Supporting documents required for COVID-19 government subsidy programs |

Ready to bring your books up to date?

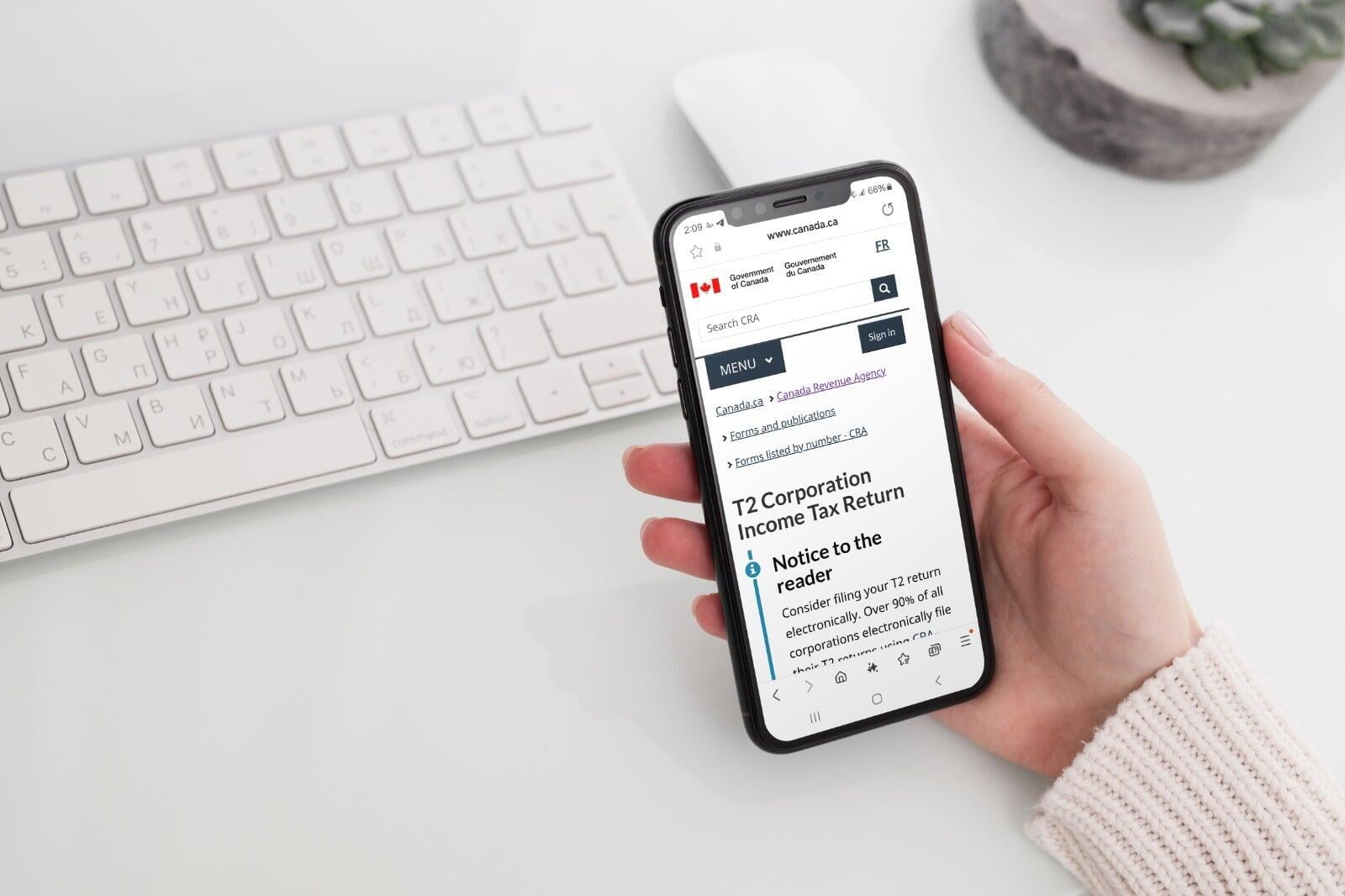

Ensuring seamless and hassle-free compliance, on time for your corporate and personal tax filings

Corporate Tax Services

Corporate Tax Services

Your Partner for All Business Sizes

Your Partner for All Business Sizes

Our seasoned tax specialists guarantee precise and punctual tax processing, leaving you with the simple task of reviewing the tax information and endorsing the results. We are here for you and your business, no matter your needs. Whether you're a small business or a larger company, we’ll help you find the most suitable corporate tax strategies.

Corporate tax solutions tailored for your company.

With our corporate and personal taxes services, you'll get:

Bi-weekly or semi-monthly direct deposit income taxes processing Bi-weekly or semi-monthly direct deposit income taxes processing Inputs for work-safe/WSIB & Employer Health Tax filings Inputs for work-safe/WSIB & Employer Health Tax filings Assistance with employee terminations & Record of Employment forms (ROEs) Assistance with employee terminations & Record of Employment forms (ROEs) |  Annual T4 & T4A processing through Payworks software Annual T4 & T4A processing through Payworks software Ensure compliance with income taxes legislation Ensure compliance with income taxes legislation Support with CRA queries and/or audits relating to corporate and personal taxes Support with CRA queries and/or audits relating to corporate and personal taxes |

Ready to offload your corporate and personal taxes?

Start-Up Services for a Successful New Business Launch

Start-Up Services for a Successful New Business Launch

Let KSBB Simplify Your New Business Start Up.

Our team is here to guide you in finding the most effective approach for your business. We understand the numerous aspects involved in establishing a new venture—especially if it’s your first time. Critical decisions, such as choosing a tax-efficient business structure and navigating the registration and incorporation processes, are vital to your brand’s long-term success. Fortunately, we’re here to help you make these decisions with confidence.

With our extensive experience in financial advisory, we provide personalized support tailored to your business’s needs. We work closely with you to design an optimal accounting system, prepare accurate financial statements, and manage tax return preparation. Additionally, we assist with various aspects of your overall business planning, ensuring you have the most valuable solutions in place as your new business takes off.

Our Start Up services may include:

Set up a versatile, scalable accounting system. Set up a versatile, scalable accounting system. Open a dedicated bank account. Open a dedicated bank account.  Track your out of pocket expenses Track your out of pocket expenses |  Apply for your business licenses and permits. Apply for your business licenses and permits. Set up CRA, GST and PST accounts. Set up CRA, GST and PST accounts. Recommend a payroll processor Recommend a payroll processor |

Starting Out? KSBB Makes Business Beginnings Easy.

I've been using KSBB for my driving school's bookkeeping and income tax preparation, and I'm extremely pleased with the service. Svetlana's attention to detail and dedication to accuracy have been invaluable. She takes the time to understand my business needs, ensuring everything is handled efficiently and correctly. Her expertise has not only saved me time but also given me peace of mind. I highly recommend KSBB to any business owner looking for trustworthy and professional bookkeeping services!

Shimon Gelblum, www.grgdrivingschool.